Mineral exploration plays a crucial role in identifying and assessing new sources of valuable minerals to meet global demand. Two primary approaches employed in mineral exploration are brownfield and greenfield exploration. Both methods aim to identify new supplies of valuable minerals, they differ in terms of the stage of exploration and the associated risks and benefits.

Brownfield exploration focuses on areas with existing mining operations or historical mining activities, while greenfield exploration targets untapped regions devoid of mining history. This blog aims to provide a comprehensive comparative analysis of brownfield and greenfield mineral exploration, examining their key differences, advantages, disadvantages, and the factors influencing their choice. The analysis explores various aspects, including geological considerations, cost factors, and risk profiles associated with each approach. This offers valuable insights for industry professionals, investors, and stakeholders to make informed decisions to maximize the success of mineral exploration projects.

Minerals are essential raw materials for various industries, including construction, manufacturing, energy, electronics, and agriculture. They are used to produce everything from buildings and infrastructure to technological devices and renewable energy technologies. As global populations and economies grow, the demand for minerals also increases, making exploration vital to ensure a steady supply of these resources.

Overall, mineral exploration is a fundamental activity that supports economic development, technological progress, and societal well-being while contributing to sustainable resource management and environmental stewardship.

Definition:

Advantages:

Limitations:

Definition:

Advantages:

Limitations:

These areas often have existing knowledge and infrastructure from previous mining operations, which can be leveraged to optimize the exploration process.

Data accessibility:

Geological understanding:

Targeted exploration:

Repurposing infrastructure:

Environmental considerations:

Stakeholder engagement:

Regulatory approvals:

Mine site rehabilitation:

Resource estimation:

In summary, brownfield exploration offers significant advantages by capitalizing on existing knowledge and infrastructure. It streamlines the exploration process, reduces costs, enhances environmental stewardship, and increases the likelihood of successful mineral discoveries in areas with a history of mining activities.

Greenfield exploration is the process of exploring for mineral deposits in areas that have not been previously explored or mined. It involves investigating new frontiers and untouched regions, often with limited or no existing geological data or infrastructure.

Discovering new mineral resources:

Resource diversification:

Long-term sustainability:

Technological advancements:

Economic growth and employment:

Regional development:

Geological knowledge expansion:

Environmental considerations:

Investment opportunities:

In conclusion, greenfield exploration is crucial for the sustainable development of the mining industry and society as a whole. It brings new discoveries, technological advancements, economic growth, and environmental stewardship, helping secure the supply of essential minerals for the future while contributing to regional development and scientific knowledge.

Brownfield and greenfield mineral exploration have distinct cost considerations due to their different characteristics and stages of development. Here are some key cost considerations for each type of exploration:

Data access and analysis:

Site evaluation:

Infrastructure reuse and rehabilitation:

Environmental considerations:

Community engagement and permitting:

Remote and challenging access:

Geological mapping and surveys:

Drilling expenses:

Infrastructure development:

Environmental baseline studies:

Social and cultural considerations:

Exploration risks:

In summary, brownfield exploration benefits from existing data and infrastructure, but costs may arise from data analysis, rehabilitation, and environmental considerations. The benefit to an investor is the potential for a takeover by a mining company looking to replenish their diminishing resources. On the other hand, greenfield exploration requires more extensive data gathering, infrastructure development, and higher risk tolerance due to the unknown geology, which can lead to higher upfront costs. Considering the higher risk tolerance, an investor can be compensated with a higher return on their investment. Both types of exploration have their challenges, and cost considerations play a vital role in determining the economic viability of mineral exploration projects.

Comprehensive site assessment:

Environmental and safety audits:

Engage with local stakeholders:

Implement a health and safety management system:

Compliance and permitting:

Risk-based exploration planning:

Contingency planning:

Regular monitoring and review:

Engage with industry experts:

By employing these strategies and practices, exploration companies can minimize operational risks associated with brownfield exploration and increase the likelihood of successful and responsible mineral discoveries. Managing risks in exploration is crucial for the overall success of the project and ensures safety, environmental sustainability, and positive community relations.

Greenfield exploration, which involves exploring for mineral deposits in previously unexplored or minimally explored areas, comes with inherent uncertainties and exploration risks. These challenges arise due to the lack of existing geological data, limited infrastructure, and the exploration of unknown terrains.

Geological uncertainties:

Exploration target selection:

Resource estimation challenges:

High exploration costs:

Logistical difficulties:

Higher drilling risk:

Permitting and regulatory challenges:

Environmental and social sensitivities:

Market and commodity price volatility:

Exploration success rate:

Despite these uncertainties and risks, greenfield exploration remains essential for discovering new mineral resources and ensuring long-term sustainability for the mining industry. Effective risk management, comprehensive data collection, careful target selection, and stakeholder engagement are crucial to increasing the chances of successful exploration outcomes in greenfield areas.

Assessing the potential for discovery or failure in greenfield exploration involves a systematic and comprehensive evaluation of various geological, technical, and economic factors. While no assessment can guarantee a definite outcome, a rigorous evaluation can help inform decision-making and increase the chances of successful exploration outcomes.

Geological Potential:

Previous Exploration Data:

Target Selection:

Drilling Strategy:

Qualified Team:

Exploration Technology:

Financial Resources:

Risk Analysis:

Monitoring and Adaptation:

Exploration Timeline:

It is essential to recognize that greenfield exploration inherently carries uncertainties and risks. Not all exploration projects will result in significant discoveries, but a thorough and well-executed exploration program increases the likelihood of success. Proper risk management, systematic data analysis, and informed decision-making are key to optimizing the potential for discovery in greenfield exploration.

Successful gold projects discovered through brownfield exploration have had a significant impact on the mining industry and the economies of the regions where they are located.

Quebec, Canada, has been a prolific region for gold exploration and mining, and numerous successful gold projects have been discovered through brownfield exploration. Here are some examples of successful gold projects in Quebec:

Canadian Malartic Mine:

Éléonore Gold Mine:

LaRonde Mine:

Sigma-Lamaque Complex:

Westwood Mine:

These examples highlight the success of brownfield exploration in Quebec, where the presence of known gold deposits and historical mining activities has facilitated the discovery and development of several prosperous gold projects.

It's essential to note that the mining landscape is continually evolving, here are some examples of brownfield exploration projects not yet in production.

Perron Gold Project:

Nelligan Gold Project:

Quebec, Canada, has also seen successful discoveries through greenfield exploration, where mineral deposits were found in previously unexplored or underexplored areas.

Éléonore Gold Mine:

Roberto Deposit:

Monster Lake Gold Project:

Sakami Gold Project:

Fenelon Gold Project:

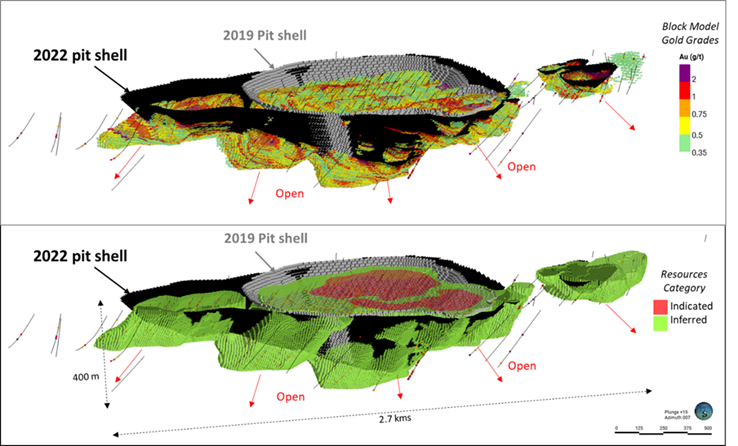

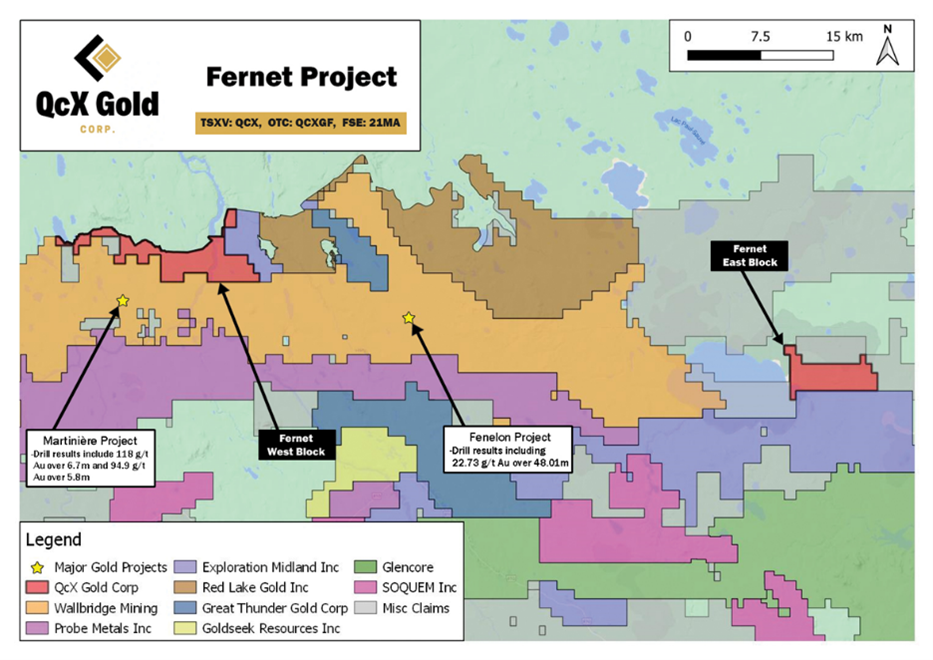

Fernet Gold Project:

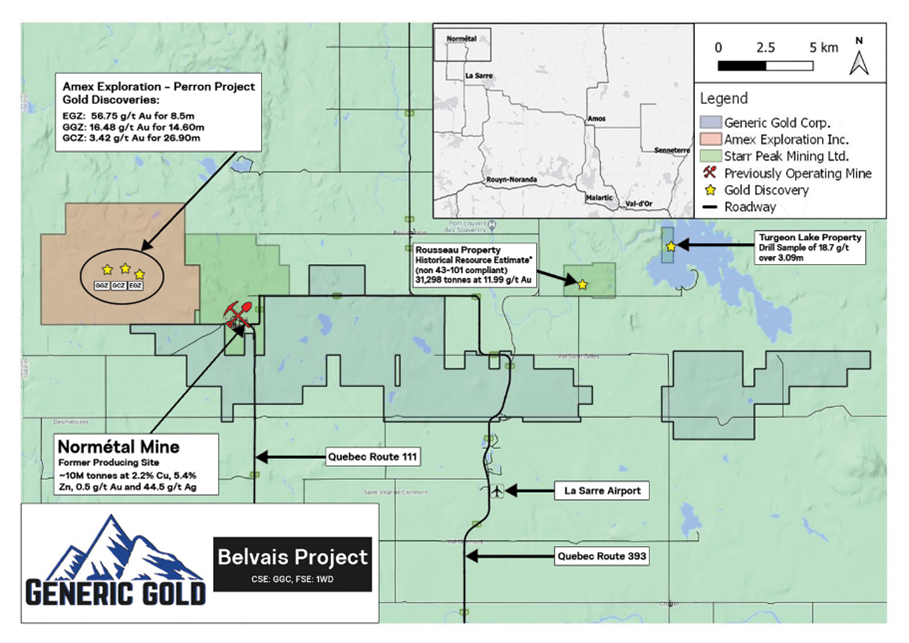

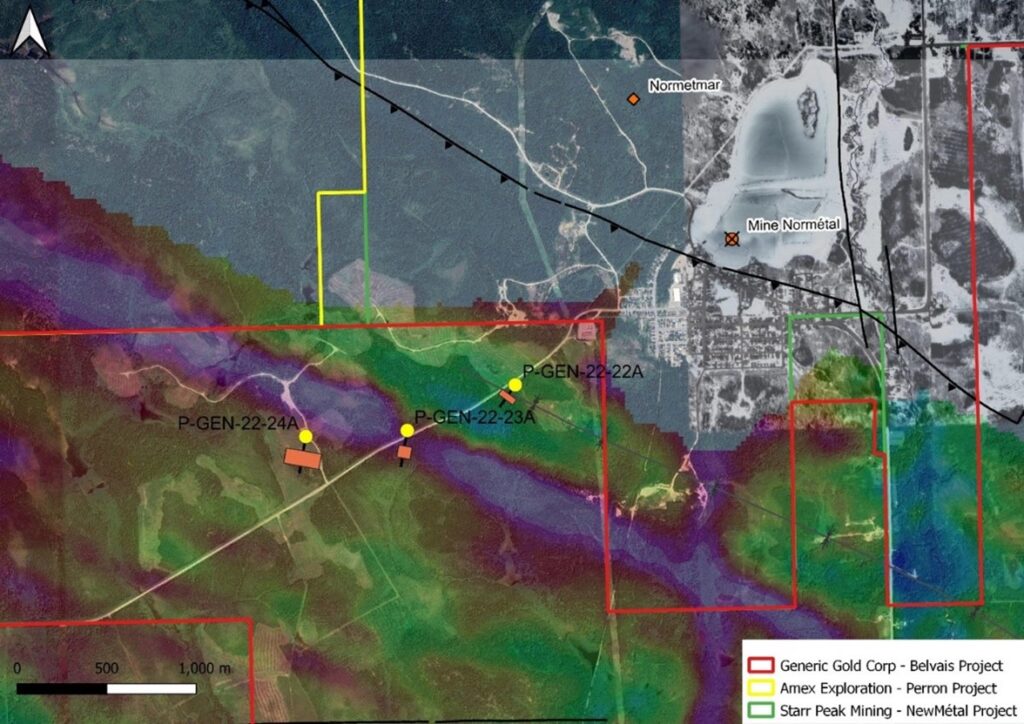

Belvais Gold Project:

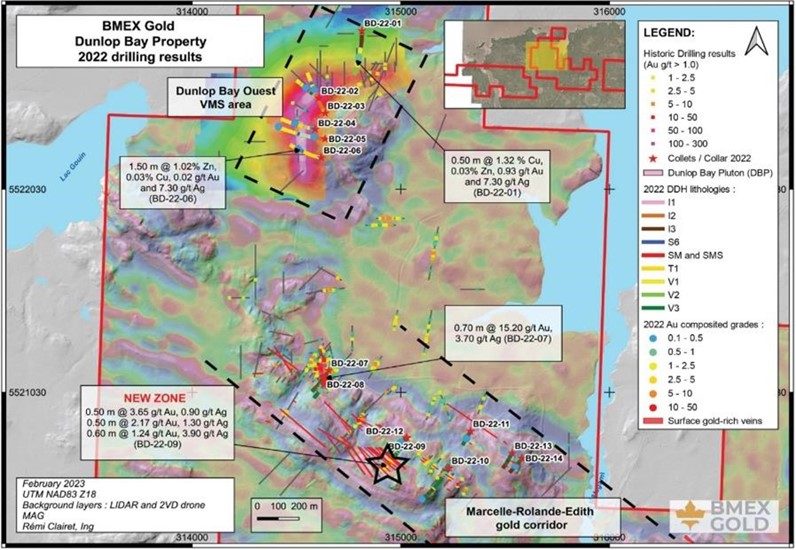

Dunlop Bay Gold and Base Metals Project

These examples illustrate the importance of greenfield exploration in Quebec and how it has led to successful discoveries of significant gold deposits in previously unexplored or underexplored areas. Greenfield exploration continues to play a crucial role in unlocking the mineral potential of Quebec and contributing to the growth of the province's mining industry.

Remote Sensing and Geospatial Technologies:

Artificial Intelligence and Machine Learning:

Unmanned Aerial Vehicles (UAVs) and Drones:

3D and Augmented Reality (AR) Visualization:

Sustainable and Responsible Exploration:

Deep Sea Mineral Exploration:

Integration of Multi-Disciplinary Data:

Collaboration and Data Sharing:

These prospects and trends indicate a shift towards more technologically advanced, sustainable, and data-driven mineral exploration practices. As the industry continues to evolve, these trends are likely to shape future exploration efforts, leading to more efficient and responsible mineral discoveries.

In summary, brownfield mineral exploration leverages existing infrastructure and knowledge in areas with previous mining activities, reducing risks and costs. Greenfield exploration, on the other hand, focuses on untapped regions with potential for major discoveries, albeit with higher risks and infrastructure challenges. The choice between these approaches depends on factors such as geological potential, available resources, environmental considerations, and the risk appetite of mining companies.

Gold has captivated human civilization for millennia, driving exploration, trade, and technological advancement. From the earliest days of gold rushes to modern mining operations, the search for this precious metal has evolved significantly. Geophysics, the study of the Earth's subsurface using physical methods, has played a pivotal role in revolutionizing gold exploration techniques. This article delves into the applications of geophysics in gold exploration, highlighting its historical development, methods, and contributions to modern mining practices.

The history of gold exploration is intertwined with geophysics, though the formal integration of the two sciences occurred gradually. During the 19th century gold rushes, prospectors relied on surface observations and rudimentary geological knowledge to identify potential gold-bearing areas. However, as the easily accessible gold deposits were exhausted, prospectors turned their attention to deeper, concealed deposits, necessitating more sophisticated exploration techniques.

In the mid-20th century, geophysics began to shape gold exploration with the advent of methods like gravity and magnetic surveys. These methods provided insights into subsurface density variations and magnetic anomalies, respectively, giving geologists clues about potential ore bodies. Ground-penetrating radar (GPR) emerged as another valuable tool, allowing direct imaging of shallow subsurface layers and enhancing the understanding of the geological context.

Magnetic Surveys:

Magnetic surveys measure variations in the Earth's magnetic field caused by underlying rock formations. Gold deposits are often associated with mineralized zones containing magnetic minerals like pyrrhotite and magnetite. By mapping these magnetic anomalies, geophysicists can identify potential gold-bearing structures and map out the geological environment.

Gravity Surveys:

Gravity surveys assess the variations in gravitational pull caused by differences in subsurface density. Gold deposits can be associated with denser rock formations due to the presence of sulfide minerals. Gravity surveys help in delineating such anomalies and inferring the potential presence of gold-bearing structures.

Electromagnetic (EM) Surveys:

EM methods measure the electrical conductivity of subsurface materials. Gold deposits are often linked with sulfide minerals, which can conduct electricity differently from surrounding rocks. EM surveys can detect conductive anomalies that may indicate the presence of mineralized zones.

Induced Polarization (IP) Surveys:

IP surveys measure the ability of subsurface rocks to hold an electric charge temporarily. In gold exploration, IP surveys are valuable for identifying disseminated sulfide minerals associated with gold deposits. IP anomalies can guide geologists toward potential ore bodies.

Seismic Surveys:

Seismic methods use sound waves to image subsurface structures. While seismic techniques are more commonly associated with oil and gas exploration, they have found applications in gold exploration to identify fault structures and potential host rocks for gold mineralization.

Ground-Penetrating Radar (GPR):

GPR employs radar pulses to image the subsurface. It is particularly useful in shallow-depth exploration, allowing detailed imaging of geological structures, soil profiles, and potential ore bodies.

Remote Sensing:

Remote sensing techniques, such as satellite imagery and aerial photography, aid in identifying surface features associated with gold mineralization, such as alteration zones or topographic signatures indicative of potential deposits.

Contributions and Challenges

The integration of geophysics into gold exploration has brought about significant advancements:

Targeted Exploration: Geophysical methods enable more focused exploration efforts, minimizing resource wastage by directing activities towards areas with higher potential for gold mineralization.

Reduced Environmental Impact: Geophysics minimizes the need for extensive drilling, reducing the environmental impact of exploration activities.

Cost Efficiency: Geophysical surveys are often more cost-effective than traditional exploration methods, especially in areas with challenging terrain or limited access.

Data Integration: Geophysical data, when combined with geological and geochemical data, provide a comprehensive understanding of subsurface structures, aiding in the development of accurate geological models.

Despite these advantages, geophysical exploration in gold mining also faces challenges:

Complex Interpretation: Geophysical data interpretation requires expertise and experience. Geologists must consider various factors, such as rock types, mineral compositions, and alteration patterns, to accurately identify potential gold deposits.

Depth Limitations: Some geophysical methods are better suited for shallow-depth exploration, while deeper deposits may require the integration of multiple methods for accurate targeting.

Geological Complexity: The geology of gold deposits can be intricate, and the relationship between geophysical anomalies and actual mineralization can be nuanced.

Ambiguity: Geophysical anomalies may indicate mineralization, but they can also arise from other geological or non-geological factors, leading to false positives.

In the realm of mineral exploration, the efficient and accurate identification of potential ore deposits is a pivotal factor. Traditional exploration methods have evolved over time, and one such innovation that has gained prominence is the Ionic Leach Geochemical Soil Survey. This survey technique has significantly transformed the mineral exploration landscape by enabling the analysis of trace elements in soil samples, aiding in the detection of subsurface mineralization.

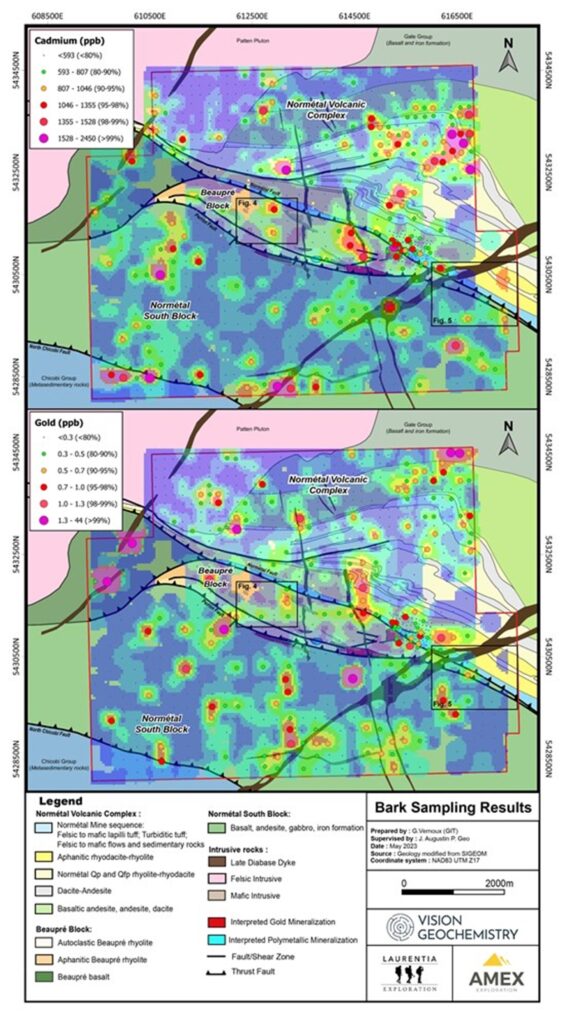

Amex Exploration employed this technique on their Perron Property with much success. Geochemical anomalies sourced from ore-grade mineralization often present sharp and high-amplitude signals, which are ideal for drill targeting. The results from the Ionic Leach geochemical survey show a strong response over the known gold zones located in the western portion of the Beaupre Block, including the Grey Cat Zone, Gratien Zone and the N110 Gold Corridor, where overburden thickness is generally much less than 20m in thickness. More information can be found on their website https://www.amexexploration.com/

Principles of Ionic Leach Geochemical Soil Survey

The Ionic Leach Geochemical Soil Survey is based on the principle that elements released through the weathering and alteration of mineral deposits can be transported by groundwater and deposited in surface soils. This process leads to the accumulation of trace elements in soils above potential mineralized zones. By analyzing the concentration of these elements in soil samples, geologists can infer the presence of underlying mineral deposits.

Methodology

Sample Collection: Soil samples are collected from the survey area using systematic grids or targeted sampling based on geological knowledge. These samples are typically taken from the uppermost layer of the soil, known as the regolith.

Leach Solution: A leach solution is created, often using a weak acid, to simulate the natural processes of weathering and leaching that occur in the environment. This solution is used to extract trace elements from the soil samples.

Elemental Analysis: The leach solution is then analyzed using various techniques, such as atomic absorption spectroscopy (AAS), inductively coupled plasma-mass spectrometry (ICP-MS), or inductively coupled plasma-optical emission spectrometry (ICP-OES). These methods provide quantitative data on the concentration of different trace elements.

Data Interpretation: The elemental concentrations are compared with established background values and known signatures of mineralization. Anomalous concentrations of specific elements can indicate potential mineralized zones beneath the soil.

Applications and Benefits

Early Stage Exploration: The Ionic Leach Geochemical Soil Survey is particularly useful in the early stages of mineral exploration when detailed geological information might be limited. It helps prioritize areas for further investigation.

Targeted Exploration: By pinpointing anomalous concentrations of specific elements, this technique aids in targeting areas with the highest potential for mineralization, thus optimizing exploration efforts.

Cost-Effectiveness: Soil sampling is less expensive and time-consuming than other methods like drilling. This makes it an attractive option for exploring large areas, especially in remote or challenging terrains.

Environmental Considerations: The survey minimizes environmental impact as it requires minimal ground disturbance and avoids the need for extensive drilling.

Multi-Element Analysis: The survey provides data on a wide range of trace elements, allowing for the identification of various types of mineral deposits beyond just a single element.

Geological Insight: Patterns of element distribution in soil can offer insights into the underlying geological processes, alteration patterns, and potential mineralization styles.

Challenges and Considerations

Data Interpretation Complexity: Interpreting anomalous elemental concentrations requires expertise. Elements can have multiple sources, and geologists must consider geological context before drawing conclusions.

Sample Representativeness: Ensuring that soil samples are truly representative of the underlying mineralization can be challenging, as factors like topography and soil types can influence results.

False Positives and Negatives: Anomalous element concentrations can also be associated with factors other than mineralization, leading to both false positives and false negatives.

Geochemical Background Variability: The natural variability of background element concentrations can complicate the identification of true anomalies.

Conclusion

The Ionic Leach Geochemical Soil Survey has revolutionized mineral exploration by providing a powerful and cost-effective tool for identifying potential mineral deposits. Through the analysis of trace elements in soil samples, geologists can gain insights into subsurface mineralization and make informed decisions about further exploration efforts. While challenges in data interpretation and sample representativeness persist, ongoing advancements in analytical techniques and geostatistical methods promise to enhance the accuracy and reliability of this technique. As the mining industry continues to seek innovative methods for responsible resource discovery.

The application of the Spruce-Bark Biogeochemical Survey offers a novel perspective by utilizing trees as indicators of subsurface mineralization. Amex Exploration also used this technique on their Perron Property to generate new drill targets. For more information view the release here.

Principles of Applying the Spruce-Bark Biogeochemical Survey in Gold Exploration

The principle behind using the Spruce-Bark Biogeochemical Survey in gold exploration is rooted in the fact that trees can accumulate trace elements from their environment, including those associated with mineral deposits. Gold-bearing ores are often associated with specific mineral assemblages that release various elements into the surrounding soil and water. Trees, particularly species like spruce, can absorb and accumulate some of these elements in their bark. By analyzing the elemental composition of tree bark samples, explorers can gain insights into the potential presence of gold mineralization beneath the surface.

Methodology

Sample Selection: To implement the Spruce-Bark Biogeochemical Survey in gold exploration, appropriate tree species need to be identified. Certain tree species, such as spruce, have been found to exhibit significant accumulation of elements associated with gold mineralization.

Sample Collection: Bark samples are collected from the selected tree species within the exploration area. Sampling locations can be determined based on geological knowledge, known gold mineralization patterns, or geophysical anomalies.

Elemental Analysis: Laboratory analysis is conducted on the collected bark samples to determine the concentrations of various elements, including those commonly associated with gold deposits, such as arsenic, antimony, and mercury.

Comparative Analysis: The obtained elemental concentrations are compared with background levels and established guidelines for mineralization. Elevated concentrations of specific elements can serve as indicators of potential gold mineralization.

Spatial Interpretation: Analyzing the spatial distribution of anomalous elemental concentrations in tree bark can help in identifying potential zones of interest for further exploration.

Benefits and Applications

Early Exploration Targeting: The Spruce-Bark Biogeochemical Survey can aid in early-stage gold exploration by providing valuable insights into areas with potential gold mineralization, allowing explorers to focus their efforts more efficiently.

Environmental Responsibility: The method is environmentally friendly, as it minimizes ground disturbance and reduces the need for extensive drilling, aligning with responsible exploration practices.

Cost Efficiency: Compared to traditional soil or rock sampling methods, bark sample collection requires less equipment and can cover larger areas in a cost-effective manner.

Integration with Other Techniques: The survey can complement existing exploration methods, such as geophysical surveys and geochemical analysis, to provide a more comprehensive understanding of potential gold deposits.

Challenges and Considerations

Species Selection: The selection of appropriate tree species is critical to ensure that the collected bark samples accurately reflect the underlying mineralization potential.

Elemental Background Levels: Establishing accurate background levels for various elements is crucial to differentiate between natural variations and potential mineralization-related anomalies.

Geological Context: The interpretation of anomalous elemental concentrations requires a deep understanding of the local geology and mineralization processes to avoid false positives.

Data Interpretation: Careful interpretation of survey results is necessary to distinguish between potential gold mineralization indicators and other environmental or geological influences.

Conclusion

The integration of the Spruce-Bark Biogeochemical Survey into gold exploration showcases the innovative strides made in modern mineral exploration techniques. By leveraging the natural ability of trees to accumulate trace elements, explorers can gain valuable insights into potential gold mineralization beneath the surface. While challenges related to species selection, background levels, and data interpretation exist, ongoing advancements in analytical techniques and interdisciplinary collaboration promise to enhance the accuracy and utility of this method. As the mining industry continues its quest for responsible and sustainable resource discovery, the Spruce-Bark Biogeochemical Survey offers a unique and valuable perspective in the pursuit of uncovering hidden gold treasures.

Gold exploration has evolved significantly over time, integrating cutting-edge technologies to enhance efficiency and accuracy. One such technology that has revolutionized the field is high-resolution Light Detection and Ranging (LiDAR). LiDAR's ability to provide detailed and precise three-dimensional terrain models has found numerous applications in gold exploration.

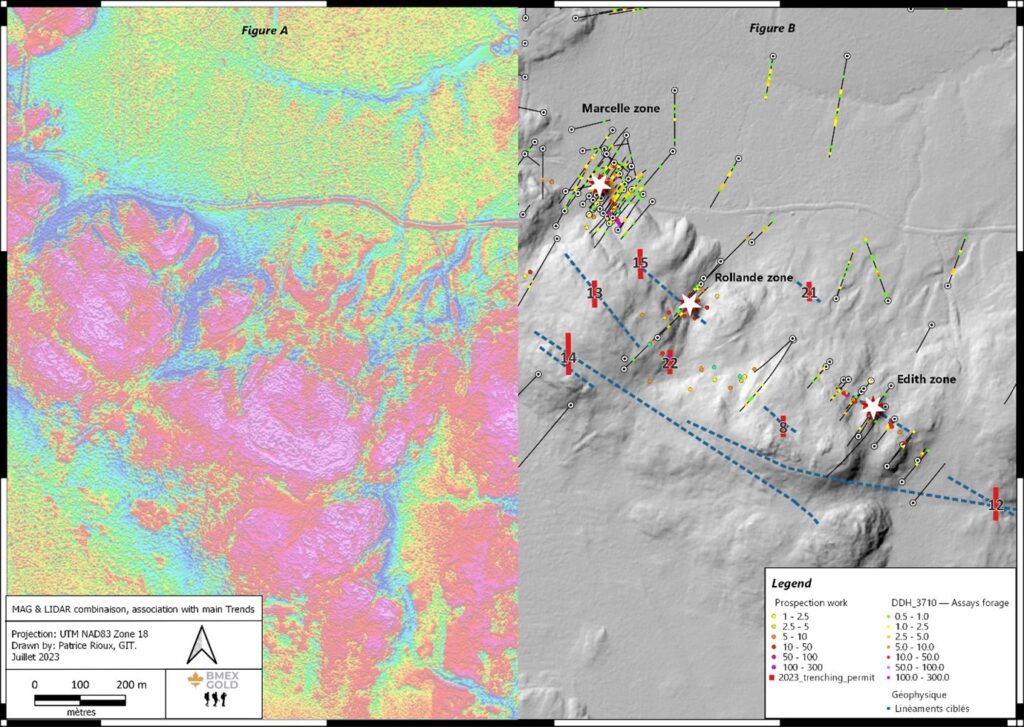

BMEX Gold (bmexgold.com) used high-resolution LIDAR to identify very prospective regions on the Marcelle-Rolande-Edith site of their Dunlop Bay Property.

Principles of High-Resolution LiDAR

LiDAR is a remote sensing technology that employs laser pulses to measure distances between the sensor and the target surface. High-resolution LiDAR, in particular, employs lasers with very high frequencies to capture intricate details of the terrain. By measuring the time it takes for the laser pulses to return after hitting the ground, LiDAR systems can generate highly accurate and dense point clouds that represent the topography and structures of the surveyed area.

Methodology

Data Acquisition: Aerial LiDAR surveys involve mounting LiDAR sensors on aircraft or drones. These sensors emit laser pulses that bounce off the ground and return to the sensor. The time taken for the return of the pulses is used to calculate the distance from the sensor to the ground.

Data Processing: The raw LiDAR data consists of millions of points in a point cloud. Specialized software is used to process and filter the data, removing noise and classifying the points into ground, vegetation, buildings, and other features.

Terrain Modeling: The filtered and classified point cloud data is used to create high-resolution digital terrain models (DTMs) and digital elevation models (DEMs) that accurately represent the surface topography.

Feature Extraction: LiDAR data can also be used to extract features such as fault lines, rock formations, and drainage patterns that are indicative of potential gold mineralization.

Applications and Benefits

Structural Analysis: High-resolution LiDAR provides detailed information about surface structures, which can help geologists identify geological features like faults and folds associated with gold mineralization.

Topographic Mapping: Accurate topographic maps created through LiDAR aid in understanding the landscape, identifying potential ore bodies, and planning exploration activities.

Drainage Patterns: LiDAR data can reveal hidden drainage patterns, helping explorers understand the movement of fluids that might be associated with gold deposits.

Alteration Mapping: LiDAR data can assist in mapping alteration zones, which are often indicative of mineralization and can guide exploration efforts.

Targeting Hotspots: LiDAR-derived structural and topographic information helps identify areas with the highest potential for gold mineralization, optimizing exploration efforts.

Challenges and Considerations

Data Interpretation: Accurate interpretation of LiDAR data requires expertise in geology and geological processes to differentiate between structural features related to mineralization and those that are not.

Vegetation Interference: Vegetation can obstruct LiDAR pulses and prevent accurate ground elevation measurements. Specialized processing techniques are used to address this challenge.

Cost: High-resolution LiDAR surveys can be expensive, particularly when covering large areas. Balancing cost-effectiveness with the survey's scope is crucial.

Data Storage and Processing: Managing and processing the large datasets generated by LiDAR surveys can pose logistical challenges, requiring specialized hardware and software.

Conclusion

High-resolution LiDAR has emerged as a transformative tool in gold exploration, offering detailed insights into the terrain and structures that might be associated with gold mineralization. By providing accurate topographic and structural information, LiDAR enhances the efficiency of exploration efforts, aiding in the identification of potential ore bodies and guiding subsequent field activities. While challenges related to data interpretation and cost exist, ongoing advancements in technology and data processing techniques continue to refine the accuracy and utility of high-resolution LiDAR in gold exploration. As the mining industry strives for more efficient and sustainable resource discovery, high-resolution LiDAR remains a vital component of the modern exploration toolbox.

Drone-based airborne magnetic surveys have proven to be valuable tools in various mineral exploration activities, including gold exploration. These surveys involve the use of specialized drones equipped with magnetic sensors to gather data about the Earth's magnetic field variations. This data can then be analyzed to identify potential mineral deposits, including gold-bearing formations.

BMEX Gold (bmexgold.com)was able to identify highly prospective gold bearing vein trends within the Marcelle-Rolande-Edith gold-bearing trend using this technique.

Here's how the process works:

Equipment Setup: The drone is equipped with a magnetometer sensor, which measures the Earth's magnetic field strength and direction. The magnetometer is calibrated and configured to ensure accurate data collection.

Flight Planning: A flight plan is designed to cover the target exploration area. The drone follows a predefined path while collecting magnetic data. The altitude, speed, and spacing of the flight lines are optimized for accurate and detailed results.

Data Collection: During the flight, the magnetometer records magnetic field data at regular intervals. The drone's GPS and other positioning systems are used to precisely determine the location of each data point.

Data Processing: After the flight, the collected magnetic data is processed and analyzed. This involves removing external magnetic interference, correcting for drone movements and altitude changes, and creating detailed magnetic field maps of the surveyed area.

Interpretation: Geophysicists and geologists interpret the magnetic field maps to identify anomalies or variations that may indicate the presence of mineral deposits, including gold. Gold-bearing formations can have distinct magnetic signatures due to the presence of certain minerals or geological structures associated with gold mineralization.

Integration with Other Data: The magnetic data is often integrated with other geological and geophysical data, such as geological mapping, geochemical analysis, and other remote sensing techniques. This multi-disciplinary approach provides a more comprehensive understanding of the subsurface geology and potential mineral deposits.

Targeting and Exploration: Based on the analysis of the magnetic data, potential target areas are identified for further exploration. Ground-based follow-up activities, such as soil sampling, trenching, and drilling, can then be focused on these areas to confirm the presence of gold mineralization.

Advantages of using drone-based airborne magnetics in gold exploration include:

Efficiency: Drones can cover large areas relatively quickly, allowing for efficient data collection and target identification.

Cost-Effectiveness: Compared to traditional airborne surveys using manned aircraft, drone surveys can be more cost-effective.

Accessibility: Drones can access remote or challenging terrains, providing access to areas that might be difficult or dangerous for ground-based surveys.

High-Resolution Data: Drones can fly at low altitudes, resulting in high-resolution magnetic data that can reveal subtle geological features.

However, it's important to note that while magnetic surveys are useful tools, they are just one component of a comprehensive exploration strategy. The interpretation of magnetic data requires expertise in geophysics and geology, and follow-up ground-based exploration is essential for confirming the presence and economic viability of gold deposits.

Also known as borehole EM or BHEM, is a geophysical method used in gold exploration to gather information about the subsurface geological and mineral properties. It involves the use of electromagnetic (EM) sensors and equipment that are lowered into boreholes (wells) drilled into the ground. BHEM can provide valuable insights into the presence of mineral deposits, including gold, and help guide further exploration efforts.

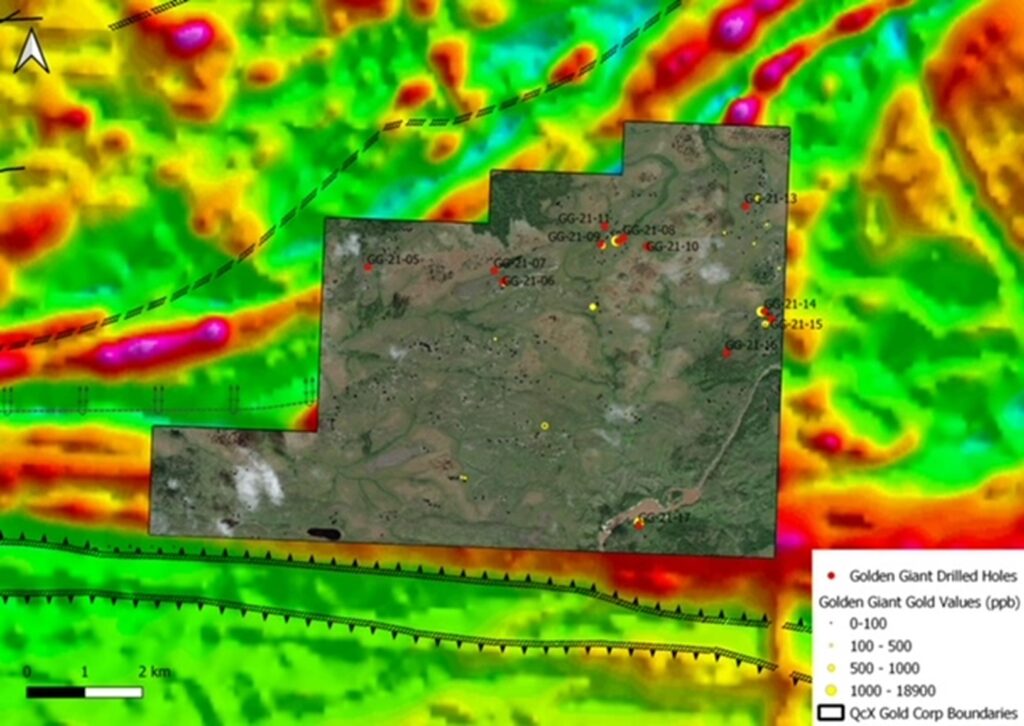

Generic Gold (genericgold.ca) discovered high-priority EM (electromagnetic) targets using BHEM (borehole electromagnetics) program (see figure below).

Here's how borehole electromagnetics is used in gold exploration:

Equipment Setup: Borehole electromagnetics typically involve the use of electromagnetic coils or transmitters that emit electromagnetic signals into the ground. These signals interact with the subsurface materials, and the resulting electromagnetic responses are measured by receivers or sensors.

Borehole Installation: Boreholes are drilled into the ground at specific locations within the exploration area. The depth and placement of the boreholes are determined based on geological knowledge and exploration objectives. The boreholes provide access to the subsurface for EM measurements.

EM Measurements: Electromagnetic transmitters are lowered into one borehole, and the receivers are placed in adjacent or nearby boreholes. The transmitter emits electromagnetic signals, and the receivers measure the responses. The responses provide information about the electrical conductivity and geological structures of the subsurface.

Data Interpretation: The collected data is processed and analyzed to create models of the subsurface conductivity variations. Changes in conductivity can indicate the presence of different geological materials, including gold-bearing formations. Geological structures that might host gold deposits, such as faults or mineralized zones, can be inferred from the conductivity data.

Integration with Other Data: BHEM data is often integrated with other geological and geophysical data, such as geological mapping, geochemical analysis, and other exploration techniques. This integration helps build a comprehensive understanding of the subsurface geology and potential mineralization.

Target Identification: Interpretation of the BHEM data can lead to the identification of potential target areas for further exploration. Follow-up activities, such as ground-based geology studies and drilling, can then be focused on these areas to confirm the presence of gold mineralization.

Advantages of borehole electromagnetics in gold exploration include:

Depth Penetration: BHEM can provide information about subsurface conductivity and geological structures at greater depths compared to surface-based methods.

Direct Measurements: BHEM provides direct measurements from the subsurface, offering insights into the conductivity variations that might indicate the presence of mineral deposits.

Resolution: BHEM can provide relatively high-resolution data that helps in identifying subtle geological features.

However, like any exploration method, borehole electromagnetics has its limitations. Interpretation of the data requires expertise in geophysics and geology. Additionally, the success of BHEM depends on the specific geological conditions of the exploration area. It's often used in conjunction with other methods to provide a comprehensive understanding of the subsurface.

It plays a crucial role in modern gold exploration by providing valuable information about potential gold-bearing areas. These images, captured from space, can reveal geological and topographical features that might indicate the presence of gold deposits.

QcX Gold (https://qcxgold.com/ ) obtained high-resolution satellite imagery of the three Golden Giant blocks from Pacific Geomatics Limited. Images were taken by Maxar satellites with resolutions of up to 15cm high definition. With this high-resolution dataset, outcrops are easily observable, which can then be mapped and digitized. This data will greatly aid geologists performing the surface prospecting program.

Here's how high-resolution satellite imagery is used in gold exploration

Geological Mapping: Satellite Imagery can provide detailed geological maps of a region. Geological features such as fault lines, fold structures, and rock formations can influence the distribution of gold deposits. By analyzing these features in high-resolution satellite images, geologists can identify areas with geological characteristics favorable for gold mineralization.

Alteration Zones: Gold deposits are often associated with specific alteration zones, where rocks have undergone chemical changes due to mineralization processes. These altered zones can sometimes be identified through spectral analysis of satellite images. Certain minerals, such as iron oxides, clay minerals, and sulfides, might be indicative of gold-bearing areas.

Topography and Drainage Patterns: The topography of an area can influence how gold deposits are distributed. High-resolution satellite imagery can reveal subtle changes in elevation and drainage patterns that may indicate the presence of gold-bearing veins or placers.

Structural Features: Gold deposits can be associated with structural features like faults and fractures. High-resolution imagery can help identify these features, which can guide geologists to potential gold-bearing zones.

Remote Sensing Techniques: Remote sensing methods, such as hyperspectral and multispectral analysis, involve capturing images in different wavelengths of light. These methods can highlight specific minerals and alterations that might be linked to gold mineralization. For example, hyperspectral analysis can identify minerals like sericite, a common alteration mineral associated with gold deposits.

Land Cover Changes: Changes in land cover, such as deforestation or soil disturbances, can provide hints about potential gold exploration sites. Satellite imagery can help track these changes over time and identify areas that might have undergone recent activities related to gold exploration or mining.

Historical Data and Trends: Satellite imagery archives provide historical data, allowing geologists to observe changes in land use and land cover over time. These trends can help identify areas that have seen gold exploration in the past or areas that are currently undergoing exploration.

Baseline Studies: Before starting a gold exploration project, baseline studies using high-resolution satellite imagery can provide a comprehensive understanding of the landscape. This information helps in planning exploration activities and targeting specific areas for detailed field studies.

Cost-Effective Initial Surveys: Satellite imagery offers a cost-effective way to conduct initial surveys over large and remote areas. This allows exploration companies to narrow down their focus to the most promising regions before committing to on-ground exploration.

Environmental Impact Assessment: High-resolution satellite imagery can be used to assess potential environmental impacts of gold exploration activities. It helps identify sensitive ecological areas that need protection during exploration and mining operations.

Overall, high-resolution satellite imagery serves as a valuable tool in gold exploration, aiding geologists and exploration companies in identifying prospective areas, optimizing their exploration efforts, and minimizing environmental impacts.

Geophysics has become an indispensable tool in modern gold exploration, revolutionizing the way mining companies identify and exploit gold deposits. From its historical roots to the present day, geophysical methods have continually evolved and contributed to more targeted and efficient exploration efforts. While challenges persist, ongoing advancements in technology and interdisciplinary collaboration hold the promise of further enhancing the accuracy and effectiveness of geophysical techniques in uncovering the Earth's hidden treasures of gold.

Investing in gold has been a popular strategy for centuries. Throughout history, gold has been seen as a symbol of wealth and has been used as a currency and a store of value. In modern times, gold has become a popular investment asset for those looking to diversify their portfolio, hedge against inflation, or protect their wealth during times of economic uncertainty.

Investing in gold can take many forms, from buying physical gold coins or bars to investing in gold mining stocks or exchange-traded funds (ETFs). Whatever form it takes, investing in gold can be an effective way to diversify your portfolio and protect your wealth.

In this article, we will explore the benefits of investing in gold, how gold can be used to hedge against inflation, and the best ways to invest in gold in Canada. We will also discuss some of the top gold stocks to watch and provide insights into how to effectively use gold as an investment asset. Whether you're a seasoned investor or just starting out, this article will provide valuable insights into the world of investing in gold.

One of the main benefits of investing in gold is its ability to act as a hedge against inflation. Inflation is the rate at which the general level of prices for goods and services is rising, resulting in a decrease in the purchasing power of money. When inflation occurs, the value of traditional investments such as stocks and bonds can be eroded, leading investors to seek alternative investment options such as gold.

Gold is often considered the best hedge against inflation because it has maintained its purchasing power over time. While the value of other investments may decline during periods of inflation, gold tends to hold its value and may even increase in value as investors seek out alternative investments.

By investing in gold, investors can protect their wealth from the effects of inflation and economic uncertainty, making it a valuable addition to any investment portfolio.

Because gold tends to hold its value or even appreciate during times of economic uncertainty, it makes gold an attractive option for investors looking to hedge against recession, which is a period of economic decline characterized by falling gross domestic product (GDP), rising unemployment, and decreased economic activity.

During recessions, many investors turn to gold as a way to protect their wealth from the effects of a downturn. This is because gold has historically performed well during recessions, often increasing in value as other assets such as stocks and bonds decline.

For example, during the 2008 global financial crisis, gold prices increased significantly as investors sought to protect their wealth from the effects of the crisis. In fact, from 2008 to 2011, gold prices more than doubled as investors flocked to the safe-haven asset.

While there are no guarantees that gold will always perform well during a recession, history has shown that it can be an effective hedge against economic uncertainty. As such, investing in gold can be a smart strategy for those looking to protect their wealth during times of economic uncertainty.

Canada has a long history of mining and is home to many of the world's leading mining companies. Investing in Canadian mining offers several advantages, including:

Investing in Canadian mining companies, including gold mining companies and junior mining companies, can provide investors with exposure to these advantages and the potential for strong returns in the gold industry. As with any investment, it's important to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

Investing in Canadian gold stocks can be a smart strategy for investors looking to hedge against inflation. Gold stocks, including those of gold mining companies and gold exploration companies, offer investors exposure to the price of gold and the potential for high returns. These companies often hold a significant amount of gold in their reserves, and as the price of gold rises due to inflation, the value of their assets can increase, potentially leading to higher stock prices.

In addition to their potential as a hedge against inflation, investing in gold mining companies and junior mining companies can also offer investors other benefits. These companies often have strong management teams, established infrastructure, and a proven track record of successful exploration and development. This can reduce the risk for investors and potentially lead to higher returns.

Investing in gold stocks can be a lucrative way to gain exposure to the precious metal and potentially earn high returns. There are many gold mining companies and junior mining companies to choose from, but it's important to do your research and choose companies that have a proven track record of success and strong financials. Some gold exploration companies and producing companies to watch:

These are just a few of the top Canadian junior mining and producing gold stocks to watch, and there are many other companies worth considering as well. Remember to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions. By staying informed and being disciplined in your investment approach, you can potentially benefit from the growth and value that the gold industry has to offer.

When investing in gold stocks, it's important to remember that the performance of the stock may not always correlate with the price of gold. Factors such as the company's financials, management team, and exploration success can all impact the stock's performance. As such, it's important to do your due diligence and research the company thoroughly before making an investment.

It's also worth noting that investing in junior mining companies can offer investors higher risk but also higher potential returns. These companies are typically focused on exploring and developing new gold deposits, which can be riskier but also potentially more lucrative than investing in established mining companies. As such, investing in junior mining companies should be approached with caution and a willingness to take on higher risk.

Overall, when investing in gold stocks in Canada, it's important to consider your investment goals, risk tolerance, and do your research before making any investment decisions. However, with the potential for high returns and the ability to hedge against inflation, investing in Canadian gold stocks, including mining companies and junior mining companies, can be a smart strategy for investors looking to diversify their portfolio and gain exposure to the precious metal.

To help you get started with investing in gold, here are some key takeaways and top tips to keep in mind:

By keeping these tips in mind and approaching gold investing with caution and a long-term perspective, you can potentially benefit from the value and diversification that this precious metal can offer to your investment portfolio.

To summarize, gold can be a valuable addition to any investment portfolio, and investing in Canadian gold stocks, including mining companies and junior mining companies, can offer exposure to the potential for high returns and a hedge against inflation. It's important to consider the different options available, including ETFs and physical gold products, and to conduct thorough research before making any investment decisions. By carefully considering your investment goals and risk tolerance, you can make informed decisions to help grow your wealth and protect your portfolio.

Remember to always conduct thorough research and seek professional advice before making any investment decisions. With a long-term perspective and a diversified portfolio, you can potentially benefit from the value and diversification that gold can offer to your investment portfolio.

Whether you're a seasoned investor or just starting out, investing in gold can be a smart choice for diversifying your portfolio and mitigating risk. By taking the time to understand the benefits and risks of investing in gold and conducting thorough research on individual companies or investment options, you can potentially see high returns and a hedge against inflation. Gold can be a valuable addition to your investment portfolio, but it should be viewed as one piece of the puzzle in achieving your financial goals.

In summary, with the current economic climate and increasing market volatility, now may be a good time to consider investing in gold as a safe haven asset and a hedge against inflation. By using the tips and advice outlined in this article, you can potentially benefit from the value and diversification that gold and investing in gold exploration and mining companies can offer to your investment portfolio.

Merger and acquisitions (M&A) are an important component of applying an evaluation to gold exploration companies, as they have no revenue and possibly no published resource. What a mining company is willing to pay for perceived ounces of gold or other metals in the ground, provides investors a benchmark for the potential value they could achieve by investing in junior gold exploration companies. This concept also applies when a producing mining company acquires another producing miner but with the added element of generated revenue to add to the valuation.

In 2022, the mining sector had 1,402 M&A deals worth US$75 billion, a decline of 34% in value from 2021. Gold was the largest component of M&A activity, with 444 transactions worth US$39 billion.1 This clearly shows that gold is still one of the hottest commodities and mining companies are actively looking for ways to replenish their depleting sources of gold production, as shown in the examples below.

A standout acquisition of a junior gold exploration company announced in December 2021 and completed in February 2022 was Kinross Gold’s purchase of Great Bear Mining. Kinross paid a 43% premium above the 20-day volume weighted trading price of Great Bear’s shares, acquiring the company for US$1.8 billion. The project is located in Red Lake, Ontario and is comprised of 9,140 hectares. At the time of the acquisition, it did not have a published resource but Kinross would have done its due diligence on drilling results to estimate how many ounces of gold could be in the ground. In February of this year, an initial resource of 5 million ounces (Moz) was published on the Great Bear project which means Kinross paid US$360 per ounce of gold in the ground, this number could be reduced when they publish an updated resource in the future.

For comparison’s sake, Osisko Mining has a market capitalization of C$1.62 billion. Their current resources on the Windfall project located in the Abitibi Greenstone Belt, James Bay region of Québec, are 7.4 Moz of gold at an average grade of 11.4 g/t Au, mainly in the indicated and inferred category. The gold grades are in the top 10 globally for projects. A feasibility study on the project published in 2022 using a US$1,600 gold price reveals an after-tax net present value (NPV) of C$1.2 billion, after-tax internal rate of return (IRR) of 34% and a two-year payback. They are expecting to achieve C$257 million average annual after-tax free cash flow per full year of production for $6.2 billion in gross revenue. They have nine drill rigs on site focused on expansion and infill drilling. As of June 2022, when they published their maiden resource, the company had drilled 1,852,861 metres. Could this company be a takeover candidate considering how advanced the project is, the high-grade gold, and the positive economics on the project?

This leads to the possibility of another acquisition of a gold exploration company, Amex Exploration. The company has drilled over 375,000 metres on its Perron project located in the Greenstone Belt, Québec and reported assay results showing multiple high-grade gold zones. The project is surrounded by producing gold mines, providing the possibility of trucking the ore to a nearby mill to save capital on building one. Amex Exploration has analyst coverage from five securities firms based in Canada, who estimate the future published resource of Amex could be between 3-5 Moz of gold. Taking the estimate of 4 Moz of gold in the ground, at a current market capitalization of US$157.9 million, this puts a value of US$39/oz on the company, making Amex Exploration an attractive target for a gold mining company in the area. More information can be found on their website https://www.amexexploration.com/

An example of an earn-in type of acquisition is Vanstar Mining’s option agreement with IAMGOLD on the Nelligan Project in Québec. In the terms of the agreement made in 2014, IAMGOLD had the option to earn 80%, initially by spending $4 million on gold exploration over four years to earn 50%. IAMGOLD then took the option to increase their stake to 75% in 2019 when they published an initial 3.2 Moz gold resource by paying Vanstar $225,000 over 3.5 years and delivering a pre-feasibility study by the end of the term. The upside is Vanstar does not have to spend any money to get this project into production. The resource was upgraded in February of this year to 5.6 Moz of gold (1.99 Moz indicated + 3.6 Moz inferred). Based on Vanstar’s 25% interest (1,375,000 oz of gold in the ground) and the current market capitalization of US$16 million, the entire company is valued at only US$11.63 per ounce of gold. To find out more about this undervalued company, check out their website https://vanstarmining.com/

Moving on to one of the bigger transactions in the M&A space, the end of 2022 saw the proposed arrangement with Yamana Gold being acquired by Pan American Silver and the sale of their Canadian assets going to Agnico Eagle. Shareholders of Yamana approved the arrangement on January 31, 2023. Yamana shareholders received US$1.0406 in cash and 0.0376 common shares from Agnico Eagle, and 0.1598 common shares from Pan American. In total, it was a US$4.8 billion takeover of Yamana. The deal was a 23% premium to Yamana’s closing price of US$4.08 on November 3, 2022.

In February of this year, Newcrest Mining announced a non-binding offer from Newmont Corporation to acquire 100% of their shares by issuing 0.380 Newmont shares per Newcrest shares. The combination would result in the combined company being 30% owned by Newcrest and 70% owned by Newmont. The proposal represents a 21% premium to Newcrest’s closing price of US$22.45 per share on February 3, 2023. The proposal has been rejected by the board of Newcrest stating it did not represent sufficient value for their shareholders. It remains to be seen if Newmont will increase its offer or if another suitor will step up to the plate. Stay tuned.

Acquisitions for smaller market capitalized gold exploration companies are usually offered at higher premiums. An example is Catalysts Metal Ltd.’s offer to acquire Superior Gold for a 62% premium above the closing price of February 22, 2023. Under the terms of the arrangement, common shareholders of Superior will receive 0.3571 shares of Catalyst, the exchange ratio represents the equivalent of C$0.44 per Superior share, which represents an equity value of C$54 million. The transaction is expected to be completed in Q2, 2023. Superior owns the operating Plutonic Gold mine in Western Australia which has a 5.9 Moz resource and 3 Mt per annum processing capacity with annual production of 62,000-65,000 oz of gold. Their reserves and resources were 630,000 oz of contained gold, 1.9 Moz of gold measured and indicated and 3.97 Moz of inferred resources.

An even larger 95% premium was paid by Alamos Gold to acquire all the shares of Manitou Gold Inc., based on their respective closing share prices of February 27, 2023. Alamos already owned 19% of Manitou Gold shares. Alamos will issue approximately 1 million shares for a total cost of C$14 million to develop district-scale targeting and exploration for the area surrounding Alamos’ Island Gold mine in Ontario, Canada. Alamos has discovered 4 Moz of high-grade gold through near-mine drilling around the Island Gold mine. Manitou Gold was a strategic low-cost junior gold exploration acquisition for them, tripling their land package along strike on the relatively underexplored Michipicoten Greenstone Belt. Manitou does not have a published resource. Investing in gold bullion, it would take 14 years to get a 95% premium on your investment based on today's gold price.

B2 Gold has offered a 45% premium to the February 10, 2023 closing share price of Sabina Gold and Silver. Under the terms, B2 Gold will issue 0.3867 common shares for each Sabina share held for consideration of C$1.87 per share, implying a total equity value for Sabina of C$1.1 billion. The rationale for acquiring Sabina is they have a fully permitted, construction ready gold project in Nunavut, Canada. A feasibility on the Goose Project shows a 15-year life of mine, producing an average 223,000 oz of gold per year.

This is the first foray into Canada for B2 Gold as their projects are in Africa and the Philippines. A Canadian acquisition for B2 Gold means enhanced operational and geographic diversification of an advanced development asset in a tier-1 mining jurisdiction. Considering the Philippines and certain countries in Africa are ranked some of the most challenging places for mining on a political and socio-economic basis, it is not surprising that B2 Gold has made a move to Canada.

It is essential to look at the best mining jurisdictions in the world as more companies are looking to make acquisitions in more stable and mining friendly areas of the world. The Fraser Institute publishes an annual survey of mining and exploration companies to rank provinces, states and countries on policy factors that may encourage or discourage mining investment. According to their 2021 survey, Western Australia moved to the top of the Investment Attractiveness Index, Saskatchewan came in second, other provinces in Canada in the top 10 were Québec and Alberta. The least attractive countries were Venezuela, Philippines, Zimbabwe, DRC, Mali, Bolivia, Kyrgyzstan and Mongolia. The survey for 2022 has not yet been published.

Canada is an attractive jurisdiction for mining companies to have operations and therefore make project acquisitions. Gold is Canada’s most mined mineral; gold exports in 2021 were valued at $21.3 billion. Canada is the world’s fourth largest producer of gold, producing 220 tonnes in 2022; twice the amount produced in 2012 and an increase of 25% compared to 2020. In 2021, Ontario and Québec produced 70% of the gold mined in Canada. The largest operating gold mine in Canada is the Malartic Mine in Québec.

The tax regime in Québec is very favourable for explorers and producing mines. Energy costs are the lowest of any province in the country. Québec has great infrastructure, a workforce with mining and exploration knowledge. The Québec government has instituted Plan Nord to develop the natural resources extraction sector to the north of the 49th parallel. This plan is expected to generate C$80 billion in energy, mining, and forestry investments. Since 2006, private investment in Northern Québec has risen by 15.9% a year, as against only 0.9% for Québec as a whole, mainly as a result of investments made in the mining sector2. In 2021, investment expenditures in the Québec mining sector rose 55% to C$4.2 billion. Exploration and deposit appraisal accounted for C$990 million, of which gold accounted for 71.5%, for a total of C$708 million3. As of 2019, Québec had approximately 30 mines and 158 exploration projects.

Considering the mergers and acquisitions occurring in Québec, this province in Canada has the potential to see a lot more in the future.

Footnotes:

Author: Bonnie Hughes

When advancing a potential mining project, there are several independently authored studies that are completed to validate the legitimacy of a mineralized deposit. These studies aim to determine the size of a resource as well as the profitability and probability of taking a project and transitioning it into production. A tremendous amount of due diligence is required by independent contractors when creating these reports, especially when producing a definitive feasibility study.

For the purpose of this article, we will assume we are discussing a gold mining project in Canada, although the process is generally the same for companies regardless of the mineral targeted.

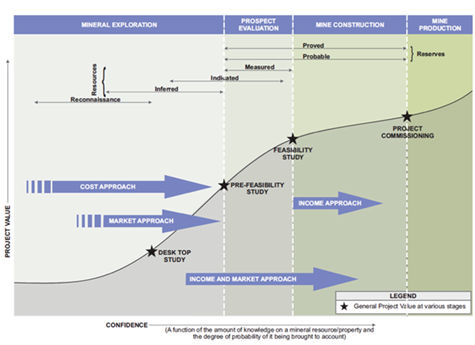

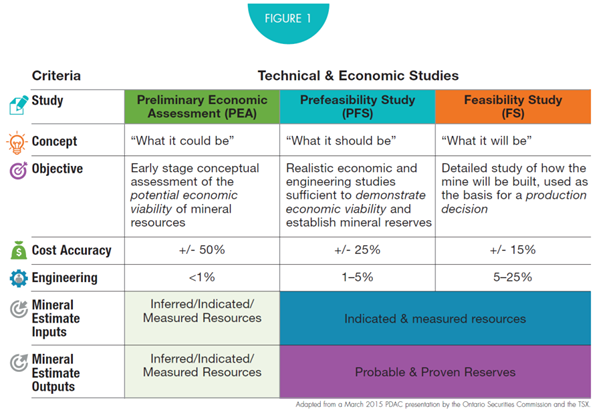

As a project progresses from the initial discovery phase to production, each published report increases confidence of the project advancing towards the eventual construction of a mine site (Figure 1). Initial reports provide a baseline of assumptions and expectations of mineralization. With subsequent reports being designed to confirm or dispel presumptions, reducing the uncertainty or risk of developing a mine.

Despite this, it is near impossible to foresee all the risks of developing a gold mine until production and operations has begun. Although these reports provide quality information to investors so that they may make an informed investment decision based on technical information rather than speculation.

Figure 1: Increased confidence with each additional report

All reports must be signed off by an independent Qualified Person (QP). The QP is a professional geologist, engineer, or geoscientist, which has completed a corresponding post-secondary educational program and has extensive experience in mineral exploration, mine development, operations, mineral project assessment, or any combination of these (typically 5+ years). Regulations and requirements for QP qualifications may vary from province to province and country to county. The QP must also have experience relevant to the subject of the mineral project and be in good standing with their given professional association. It is the responsibility of the QP to review the report, ensuring that there is no misleading information presented that all given statements are scientifically accurate. Once a QP signs off on a report, they confirm the reports validity and are now responsible for the information provided.

The first report required after the discovery phase is a compliant NI 43-101 resource estimate, which is used in North America or a JORC report used in Australia and Africa.

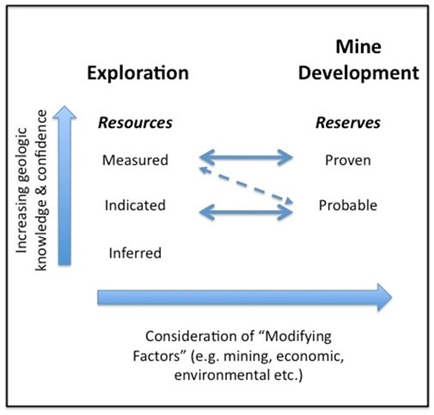

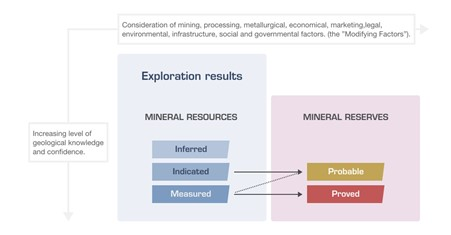

Mineral resources are arranged into three categories: measured, indicated, and inferred resources of the project. Measured resources are the highest degree of confidence in a resource estimate. Figure 2 below shows the measure of confidence each level of resource provides.

Figure 2: Confidence each level of resource provides

The objective of the technical report is to summarize scientific material and technical information concerning mineral exploration, development, and production activities on a mineral property. Required information in the technical report includes property description and ownership, geology and mineralization, status of exploration, development and operations, mineral resource and mineral reserve estimates, concluding with qualified person’s statements and recommendations. At this stage, there is limited information on economic assumptions or detailed mining and processing activities.

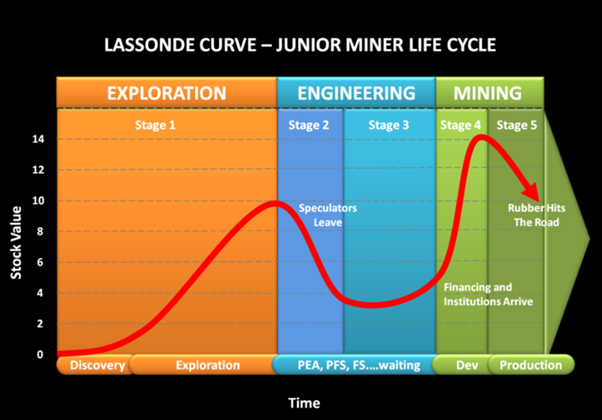

It is at this point in a mine’s lifecycle where many financial investors see a large value proposition in the stock of a gold exploration company. The risk is high, but returns can also be high. For more information, check our blog on JUNIOR MINING COMPANY LIFE CYCLE

To reach an eventual resource calculation the gold exploration company must first drill the mineralized zone within specified spacing requirements (which vary depending on the ore body size and the commodity) to provide the QP with sufficient data on the proportions and orientation of the gold mineralization. Once a resource estimate has been filed, investors tend to correlate the value of the company’s shares by the project’s determined ounces in the ground, its jurisdiction and access to infrastructure and skilled labour. For example, investors may value a company with a 1-million-ounce NI 43-101 compliant gold resource in Quebec, Canada at a higher premium than a 1-million-ounce gold project in a politically unstable country or a project located in a very remote area simply because the risk factor is higher.

Gold exploration companies are also keen to demonstrate that their deposits may have sizeable amounts of mineralization that has yet to be discovered. Implying that the mineralized zone is still open to be further discovered at depth or along strike. This concept means there is a prospective opportunity that the resource estimate may grow as drilling continues, therefore providing immense potential for the value of the asset to steadily increase or a ‘blue sky’ opportunity for the gold investor.

For example, Amex Exploration is completing 300,000m of drilling prior to filing their first NI 43-101. Once this initial report is filed, they may opt to start economic studies and/or continue with additional drilling, increasing the size of the resource estimate as well as the level of confidence. Once more advanced economic studies commence, the categorization of the deposit moves from ‘resources’ into the ‘reserves’ categories. Meaning there has been sufficient research and modelling given towards the mine-ability of the ore body from a both a technical and economic perspective.

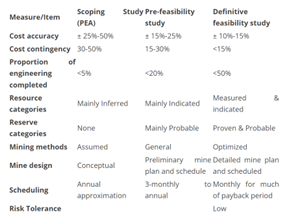

The table below gives a general overview of what to expect from mining studies. The cost percentages are given as an approximate guideline.

It is often seen that companies will exceed their capex (capital expenditure) even after the definitive feasibility study. Therefore, a monetary contingency is required in the event of budget overruns, although, even despite proper planning, certain factors may arise that were not considered. An example of this may include projects located in extremely remote areas, which may lack water, power, and road access to the mine. This lack of infrastructure may have a compounding effect, plaguing the project with extensive complications and increased capital costs. Additionally, there may be unpredictable risks with politically unstable countries as governmental regulation may slow or halt a project entirely.

Rule of thumb confidence intervals for technical studies (at assumed 90% confidence)

A preliminary report determines key project risks, further pre-development efforts required and whether to proceed forward with the project depending on the initial analysis of factors. This report is a preliminary assessment and does not provide an accurate/in-depth assessment of the economic viability of a project.

This study determines whether the identified resources can support a viable mining project. The report is accurate by approximately 15-30%. This report begins to give initial measure of the economic viability of a project which will justify proceeding towards the creation of a definitive feasibility study (DFS). If the resulting report is positive, the project would require additional funding with the eventual expansion of the drilling program. The closer a project trends towards the completion of a definitive feasibility study (DFS) there is a higher potential to attract strategic partners or a buyer of the company/asset. As a project begins to gather more attention from the public and large-scale mining companies, the gold company will begin to have less difficulties securing project funding from investors and lenders.

After-tax internal rate of return (IRR) %, and net present value (NPV) based on the current price of gold, additional calculations may be included made using a lower/higher price of gold dependent sensitivity rates.

This is an in-depth, comprehensive report that considers many elements, including but not limited to: detailed engineering work, infrastructure requirements, mining methods, recovery methods, market studies, environmental studies, permitting, social and community impact, as well as reclamation costs.

From this report, a risk profile is established and mitigation strategies are developed to further reduce uncertainty.

Demonstrate with reasonable confidence that the project can be constructed and operated in a technically sound and economically viable manner.

Provide a basis for detailed design and construction.

Enable the raising of finance for the project from banks or other sources.

This report is produced in the hope of securing project financing from banks, debt providers, strategic investors, etc. With these capital investments being used to construct the gold mine’s infrastructure and start production. The project financiers will also conduct their own due diligence with their experts before providing any capital and this can take several months.

In the past few years, major producers have not been spending capital to replace their declining reserves due to a downturn in the commodity markets. Therefore, they must look elsewhere for ore to feed their depleting mills, often turning their attention to exploration companies that have already completed the work necessary to prove the economic viability of a project. This means the potential for mergers and acquisitions may be high in the current commodity cycle. A recent example is QMX Gold which was acquired on January 21, 2021 by Eldorado Gold for approximately C$132 million, the consideration represented a 39.5% premium to the previous day’s share price.

Through these studies, the exploration companies define the ore body and demonstrate the viability. As the risk factors lower, investors with different risk profiles enter at the different stages of the resource definition. It is up to the individual to decide their risk/return tolerance and at what point they want to invest in gold exploration companies.

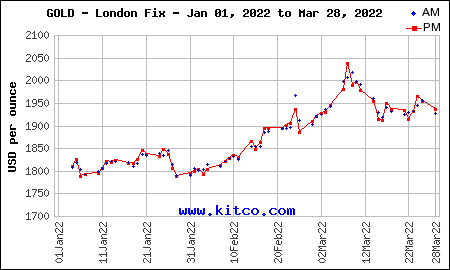

The price of gold rose dramatically, as the invasion caused serious worldwide concern, gold became a safe haven (risk-on) for investors and countries (Figure 1). Russia’s invasion of the Ukraine has been one of the biggest geo-political risks since World War II. The price of gold achieved a new high of US$2,039 in March 2022.

Recent peace talks between Russia and the Ukraine caused a slight reversal in the risk-on trade of buying gold but where could the price ultimately end up? For the moment, there is no resolution, so it is worthwhile to review the history of past conflicts and economic uncertainty to see if there is a possible conclusion as to what direction the gold price is heading.

Figure 1

It is not the first time Russia has invaded the Ukraine, so it is worth a review of what happened to the gold price in the previous situation. The revolution of Dignity also known as the Maidan Revolution was a result of large-scale protests against the Ukrainian President Viktor Yanukovych’s decision not to join the EU and instead forge closer ties with Russia. Ultimately, the president and the Ukrainian government were overthrown. The capital of Kyiv came under control of the protesters and an interim government was formed. The overthrown president asked Russia to intervene which resulted in the annexation of Crimea and started the Donbas War.

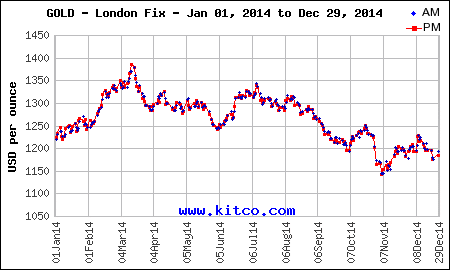

The gold chart for the year of 2014 showed a rise in the gold price as the conflict escalated (Figure 2) and subsequently fell to a level which was lower than the start of the year as a ceasefire (Minsk Protocol) was signed in September 2014. The current situation with Russia is under different circumstances so we cannot assume a resolution will lead to a weakness in the gold price.

Figure 2

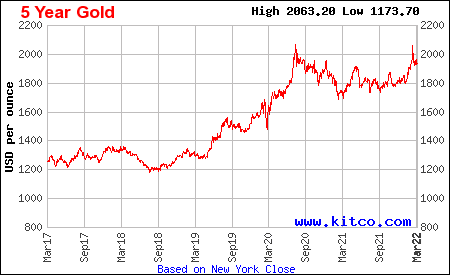

The financial crisis was one of the worst since the Great Depression. The US gross domestic product fell 4.3% from peak to trough, the unemployment rate more than doubled from less than 5% to 10%. The first indication that the US economy was not all that it seemed, was when Lehman Brothers on September 15, 2008, declared bankruptcy. The following day the US government announced the bailout of AIG Insurance to the tune of US$85 billion. In December 2008, the Case-Shiller home price index reported its largest drop in history. The burst of the housing bubble was the main cause of the crisis at this time, it had a knock-on effect causing massive mortgage defaults by consumers which in turn caused lending institutions to go into bankruptcy. There was also a massive decline in the value of mortgage-backed securities due to sub-prime lending. This led to an interbank credit freeze causing a lack of liquidity in the system, as banks did not want to provide loans. The crisis caused an upward trajectory in the gold price, where it achieved a new high of $1896.50 in 2011 (Figure 3). It could be said the bursting of the housing bubble created a bubble in the gold price, which deflated with a much less dramatic effect on the economy then the financial crisis.

Figure 3

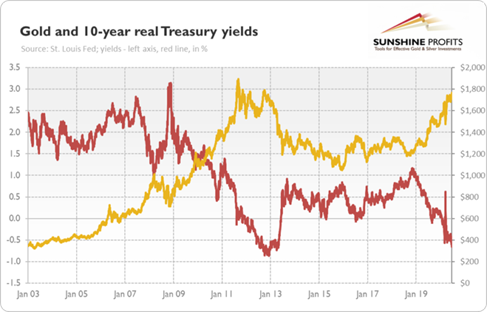

The increase in the price of gold was rooted in the world economic collapse of 2009. The peak in 2011 (Figure 3) was a result of quantitative easing by world central banks and unprecedently low global interest rates which meant real rates were negative so holding cash in the bank resulted in the loss of purchasing power, a negative return. In addition to the economic uncertainty, there was unrest in the Middle East causing concerns the price of oil would rise. There was the Fukushima nuclear disaster in Japan in March 2011, caused by a Tsunami which rattled the markets and questioned Japan’s ability to recover from the disaster.

In Q1 of 2013 the start of the decline in the gold price was triggered by Cyprus, suggesting it would sell half a billion of its gold reserves to fulfil its €10 billion EU/IMF bailout. By the end of 2013 the Cyprus central bank said it would not sell its gold reserves to cover the bailout.

Another contributor was the announced reduction in Quantitative Easing (QE) also known as Fed Tapering, where governments reduce buying bonds from financial companies and pension funds to lower interest rates for consumers and businesses, this meant a slight rise in interest rates but at this time inflation was not a factor which is an important consideration when looking at real versus nominal interest rates to be addressed later.

QE is still in use today by many governments due to the Covid situation. The US Federal Reserve has doubled its balance sheet of long term-securities since the start of the pandemic from $4.31 trillion to $8.87 trillion. This injects more fiat money into the system which gold bugs say justifies a doubling in the gold price from its current level. If it were only that simple.

The Corona Virus or COVID 19 is a pandemic not seen since the Spanish Flu in 1918. The world was not prepared to deal with the pressures on the human population and healthcare which initially resulted in a lot of confusion and chaos. It was unknown as to what the worldwide effects would be. The decision to shut down social venues and workplaces from March 2020 to the end of 2021, negatively affected global economies. The five-year gold chart below (Figure 4) reveals gold was range bound between $1200-$1300 in the two years prior to the pandemic. As the pandemic continued the gold price progressed forward to a new all-time high of $2074.88, thanks in part to QE. As restrictions were lifted the gold price moved to a low of $1683.95 in March of 2021. The pandemic has not ended so it is unknown as to what the future holds for the gold price in relation to the pandemic.

Figure 4

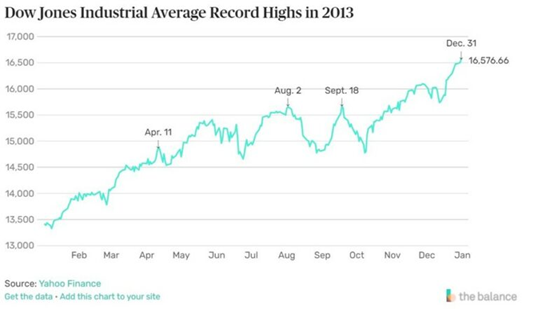

By the end of 2013 the Dow Jones Index reached a record high and had increased 26% over the year, (Figure 5) making equities more attractive to investors than gold. After the 2008-2009 financial crisis, investors were feeling more confident about the economy as quantitative easing pumped a lot of liquidity into the system. As an example, one could borrow at low rates and invest in the market to achieve higher returns than the rate of borrowing. Could this be another bubble as interest rates rise, only time will tell.

Figure 5

The trajectory of the Dow Jones Index has continued since 2013 (Figure 6) which contributed to the decline in the gold price from that time (Figure 3) until the start of the pandemic in 2019, where there was a pull-back in stocks due to the uncertainty surrounding COVID. Rising equities was not the only contributing factor to the decline in the gold price but it was influential.

Figure 6