Mineral exploration and discovery are often the most exciting time of a mining company’s life cycle. It is the period when discoveries of minerals, like gold, are being made and companies can overnight become a huge success with their peers as well as shareholders. An example of a junior gold mining company that has made a significant gold discovery in Quebec and whose shareholders have been rewarded by a serious lift in its share price is TSX.V-AMX or OTCQX - AMXEF. They have also been recognized by their peers and have been nominated for Discovery of the Year in Quebec.

To make these discoveries, junior mining companies raise capital to fund exploration programs which range in size and scope depending on the budget, location, availability of skilled labour, permitting, etc. Using our example, Amex Exploration has been able to raise $46M for further exploration and to make additional high grade gold discoveries. Being located right outside a town with skilled labour and ample infrastructure they can take advantage of low exploration cost and get the most bang for their buck.

Given it is such an exciting time in the life of a mining company, many investors focus exclusively on investing in junior mining exploration companies and here is why!

The share price of a company that makes a mineral (gold) discovery can provide more than a 100% return on investment. As the size of the discovery grows so can the return on investment.

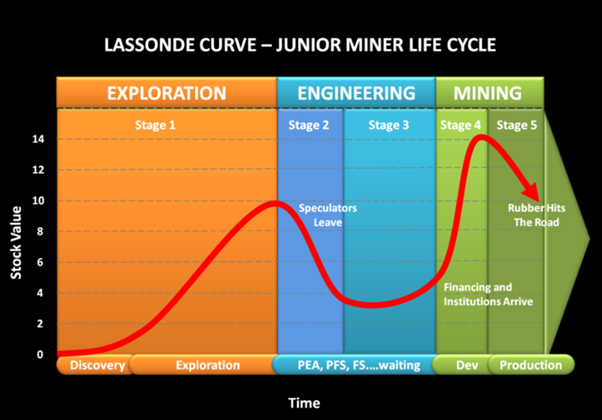

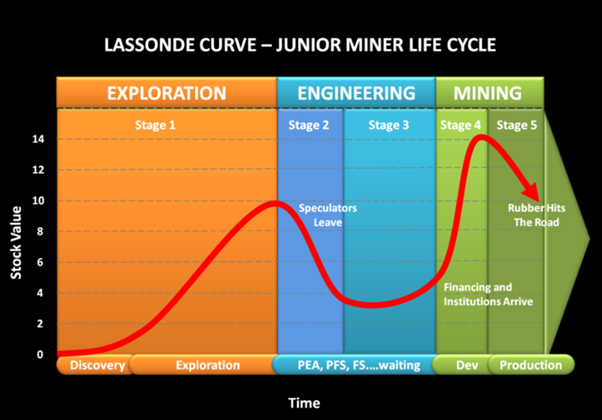

The Lassonde Curve is considered to be a realistic depiction of the stages of a junior mining company as it correlates to its stock price. In the case of Amex Exploration, the Company is still in the discovery and exploration phase meaning ample upside should remain in the stock.

Exploration compensates an investor for the risk taken due to the fact that the company is not generating cash flow, by providing the potential for a much greater return on money invested. Going from initial discovery to building a sizeable resource deposit is stage 1. Stage 1 also provides the investor with the best leverage to the price of the commodity, especially gold.

For the balance of this blog, we will assume we are discussing a junior gold mining company, although the process is true of virtually all commodities. When a company stakes a claim to explore a property, it is usually because they believe there is the possibility of finding gold mineralization. The belief of a gold discovery can be due to historical data as well as proximity to producing gold mines or discoveries. There is an old mining adage which goes like this “the best way to find a new mine is to look in the shadow of a headframe.”

Prior to drilling, a junior mining company establishes a plan of where to drill, especially when no previous work has ever been done on a property. There are many tools that junior mining companies use to discover gold. These tools include modern geophysical surveys, 3D modelling, and good old fashion “boots on the ground”: conducting soil sampling, chip sampling and trenching.

Essentially, it is data gathering and modelling and it is required to ensure maximum chances to make a gold discovery. The market capitalization of a company at this phase is usually at its lowest point and it is where the highest risk takers will invest.

Once all the surface work is completed, it is time for drilling for a new gold discovery or confirming that the historical work on the property is accurate. Drill core is split and logged and sent to the lab for assay. As assay results are released and they prove to be interesting, an investor can begin to see a rise in the share price, sometimes dramatically if the results show high grade gold or gold broadly disseminated over large widths.

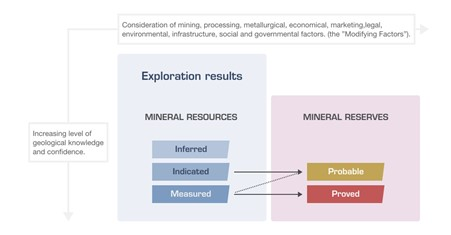

The next objective in the exploration cycle is to establish an initial resource to prove the size and average grade of the deposit. A gold resource would be a concentration of gold in a defined area, with a grade and quantity that one could reasonably expect to mine. There are various stages of confidence when it comes to a resource which is displayed in the image below. The levels of confidence are obtained by closer drill spacing.

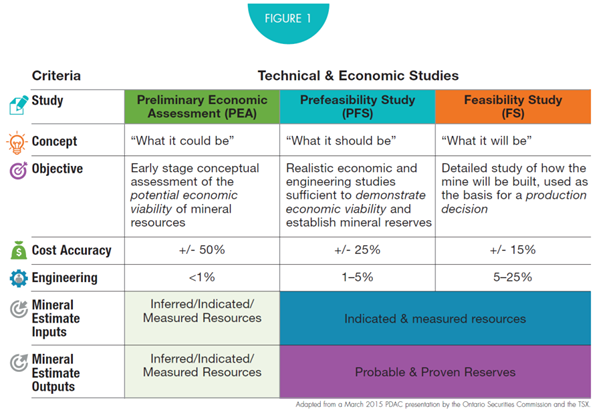

Stage 2 and 3 are all about defining the economic viability of building a mine through various economic studies (Preliminary Economic Assessment, Pre-Feasibility Study and Feasibility Study). These demonstrate with increased certainty at each level that there is enough of the mineral (gold) in the ground to develop an economic mine. Many factors influence the economics of a potential gold mine including the current price of gold and presumed price in the future, the location and jurisdiction of the gold project, access to infrastructure and skilled labour, community acceptance, the environmental impact, etc. It is during this stage that some speculative investors begin to sell their shares and new investors with less risk tolerance buy shares.

The table below shows the various economic studies. The Feasibility Study is the most detailed and advanced of the studies and is usually required prior to launching project financing and construction.

Depending on the jurisdiction, the company will also have to do an Environmental Impact Assessment. It is a comprehensive report detailing how the mine will affect the environment (land, water air) and human health impacts, both beneficial and adverse. It will also look at returning the land back to its original state before the mine was constructed, this is called reclamation. A construction permit for building the mine cannot be granted without an EIA.

Once all the studies and project financing are completed, the Company enters stages 4 and 5. As a gold company gets closer to pouring its first bar of gold, the stock price begins to appreciate in anticipation of earnings and profitability. At this point, the junior mining company has graduated to gold producer. Speculation and risk both transition as the stock begins to trade in line with its financials and quarterly production projections. Share price appreciation can take place throughout the life cycle of a junior mining company, but the first major rise stock price comes in the initial discovery phase. It is what keeps speculative investor coming back for more.