Investing in gold has been a popular strategy for centuries. Throughout history, gold has been seen as a symbol of wealth and has been used as a currency and a store of value. In modern times, gold has become a popular investment asset for those looking to diversify their portfolio, hedge against inflation, or protect their wealth during times of economic uncertainty.

Investing in gold can take many forms, from buying physical gold coins or bars to investing in gold mining stocks or exchange-traded funds (ETFs). Whatever form it takes, investing in gold can be an effective way to diversify your portfolio and protect your wealth.

In this article, we will explore the benefits of investing in gold, how gold can be used to hedge against inflation, and the best ways to invest in gold in Canada. We will also discuss some of the top gold stocks to watch and provide insights into how to effectively use gold as an investment asset. Whether you're a seasoned investor or just starting out, this article will provide valuable insights into the world of investing in gold.

One of the main benefits of investing in gold is its ability to act as a hedge against inflation. Inflation is the rate at which the general level of prices for goods and services is rising, resulting in a decrease in the purchasing power of money. When inflation occurs, the value of traditional investments such as stocks and bonds can be eroded, leading investors to seek alternative investment options such as gold.

Gold is often considered the best hedge against inflation because it has maintained its purchasing power over time. While the value of other investments may decline during periods of inflation, gold tends to hold its value and may even increase in value as investors seek out alternative investments.

By investing in gold, investors can protect their wealth from the effects of inflation and economic uncertainty, making it a valuable addition to any investment portfolio.

Because gold tends to hold its value or even appreciate during times of economic uncertainty, it makes gold an attractive option for investors looking to hedge against recession, which is a period of economic decline characterized by falling gross domestic product (GDP), rising unemployment, and decreased economic activity.

During recessions, many investors turn to gold as a way to protect their wealth from the effects of a downturn. This is because gold has historically performed well during recessions, often increasing in value as other assets such as stocks and bonds decline.

For example, during the 2008 global financial crisis, gold prices increased significantly as investors sought to protect their wealth from the effects of the crisis. In fact, from 2008 to 2011, gold prices more than doubled as investors flocked to the safe-haven asset.

While there are no guarantees that gold will always perform well during a recession, history has shown that it can be an effective hedge against economic uncertainty. As such, investing in gold can be a smart strategy for those looking to protect their wealth during times of economic uncertainty.

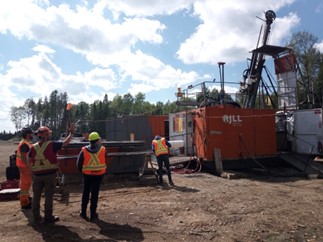

Canada has a long history of mining and is home to many of the world's leading mining companies. Investing in Canadian mining offers several advantages, including:

Investing in Canadian mining companies, including gold mining companies and junior mining companies, can provide investors with exposure to these advantages and the potential for strong returns in the gold industry. As with any investment, it's important to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

Investing in Canadian gold stocks can be a smart strategy for investors looking to hedge against inflation. Gold stocks, including those of gold mining companies and gold exploration companies, offer investors exposure to the price of gold and the potential for high returns. These companies often hold a significant amount of gold in their reserves, and as the price of gold rises due to inflation, the value of their assets can increase, potentially leading to higher stock prices.

In addition to their potential as a hedge against inflation, investing in gold mining companies and junior mining companies can also offer investors other benefits. These companies often have strong management teams, established infrastructure, and a proven track record of successful exploration and development. This can reduce the risk for investors and potentially lead to higher returns.

Investing in gold stocks can be a lucrative way to gain exposure to the precious metal and potentially earn high returns. There are many gold mining companies and junior mining companies to choose from, but it's important to do your research and choose companies that have a proven track record of success and strong financials. Some gold exploration companies and producing companies to watch:

These are just a few of the top Canadian junior mining and producing gold stocks to watch, and there are many other companies worth considering as well. Remember to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions. By staying informed and being disciplined in your investment approach, you can potentially benefit from the growth and value that the gold industry has to offer.

When investing in gold stocks, it's important to remember that the performance of the stock may not always correlate with the price of gold. Factors such as the company's financials, management team, and exploration success can all impact the stock's performance. As such, it's important to do your due diligence and research the company thoroughly before making an investment.

It's also worth noting that investing in junior mining companies can offer investors higher risk but also higher potential returns. These companies are typically focused on exploring and developing new gold deposits, which can be riskier but also potentially more lucrative than investing in established mining companies. As such, investing in junior mining companies should be approached with caution and a willingness to take on higher risk.

Overall, when investing in gold stocks in Canada, it's important to consider your investment goals, risk tolerance, and do your research before making any investment decisions. However, with the potential for high returns and the ability to hedge against inflation, investing in Canadian gold stocks, including mining companies and junior mining companies, can be a smart strategy for investors looking to diversify their portfolio and gain exposure to the precious metal.

To help you get started with investing in gold, here are some key takeaways and top tips to keep in mind:

By keeping these tips in mind and approaching gold investing with caution and a long-term perspective, you can potentially benefit from the value and diversification that this precious metal can offer to your investment portfolio.

To summarize, gold can be a valuable addition to any investment portfolio, and investing in Canadian gold stocks, including mining companies and junior mining companies, can offer exposure to the potential for high returns and a hedge against inflation. It's important to consider the different options available, including ETFs and physical gold products, and to conduct thorough research before making any investment decisions. By carefully considering your investment goals and risk tolerance, you can make informed decisions to help grow your wealth and protect your portfolio.

Remember to always conduct thorough research and seek professional advice before making any investment decisions. With a long-term perspective and a diversified portfolio, you can potentially benefit from the value and diversification that gold can offer to your investment portfolio.

Whether you're a seasoned investor or just starting out, investing in gold can be a smart choice for diversifying your portfolio and mitigating risk. By taking the time to understand the benefits and risks of investing in gold and conducting thorough research on individual companies or investment options, you can potentially see high returns and a hedge against inflation. Gold can be a valuable addition to your investment portfolio, but it should be viewed as one piece of the puzzle in achieving your financial goals.

In summary, with the current economic climate and increasing market volatility, now may be a good time to consider investing in gold as a safe haven asset and a hedge against inflation. By using the tips and advice outlined in this article, you can potentially benefit from the value and diversification that gold and investing in gold exploration and mining companies can offer to your investment portfolio.