When advancing a potential mining project, there are several independently authored studies that are completed to validate the legitimacy of a mineralized deposit. These studies aim to determine the size of a resource as well as the profitability and probability of taking a project and transitioning it into production. A tremendous amount of due diligence is required by independent contractors when creating these reports, especially when producing a definitive feasibility study.

For the purpose of this article, we will assume we are discussing a gold mining project in Canada, although the process is generally the same for companies regardless of the mineral targeted.

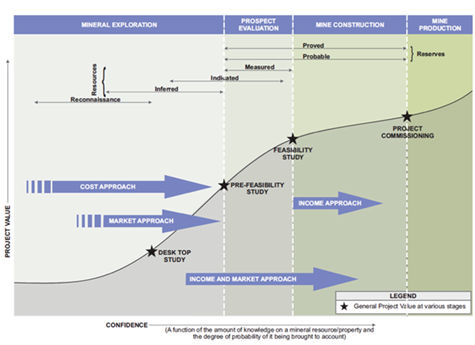

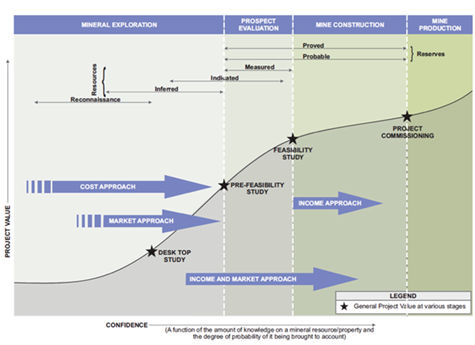

As a project progresses from the initial discovery phase to production, each published report increases confidence of the project advancing towards the eventual construction of a mine site (Figure 1). Initial reports provide a baseline of assumptions and expectations of mineralization. With subsequent reports being designed to confirm or dispel presumptions, reducing the uncertainty or risk of developing a mine.

Despite this, it is near impossible to foresee all the risks of developing a gold mine until production and operations has begun. Although these reports provide quality information to investors so that they may make an informed investment decision based on technical information rather than speculation.

Figure 1: Increased confidence with each additional report

All reports must be signed off by an independent Qualified Person (QP). The QP is a professional geologist, engineer, or geoscientist, which has completed a corresponding post-secondary educational program and has extensive experience in mineral exploration, mine development, operations, mineral project assessment, or any combination of these (typically 5+ years). Regulations and requirements for QP qualifications may vary from province to province and country to county. The QP must also have experience relevant to the subject of the mineral project and be in good standing with their given professional association. It is the responsibility of the QP to review the report, ensuring that there is no misleading information presented that all given statements are scientifically accurate. Once a QP signs off on a report, they confirm the reports validity and are now responsible for the information provided.

The first report required after the discovery phase is a compliant NI 43-101 resource estimate, which is used in North America or a JORC report used in Australia and Africa.

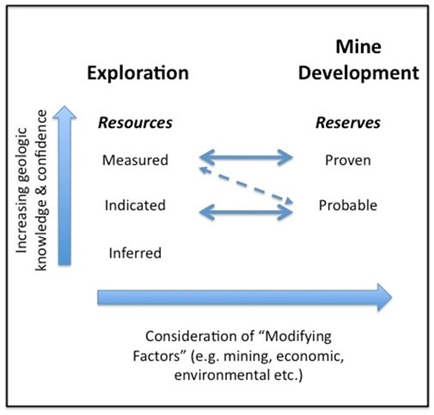

Mineral resources are arranged into three categories: measured, indicated, and inferred resources of the project. Measured resources are the highest degree of confidence in a resource estimate. Figure 2 below shows the measure of confidence each level of resource provides.

Figure 2: Confidence each level of resource provides

The objective of the technical report is to summarize scientific material and technical information concerning mineral exploration, development, and production activities on a mineral property. Required information in the technical report includes property description and ownership, geology and mineralization, status of exploration, development and operations, mineral resource and mineral reserve estimates, concluding with qualified person’s statements and recommendations. At this stage, there is limited information on economic assumptions or detailed mining and processing activities.

It is at this point in a mine’s lifecycle where many financial investors see a large value proposition in the stock of a gold exploration company. The risk is high, but returns can also be high. For more information, check our blog on JUNIOR MINING COMPANY LIFE CYCLE

To reach an eventual resource calculation the gold exploration company must first drill the mineralized zone within specified spacing requirements (which vary depending on the ore body size and the commodity) to provide the QP with sufficient data on the proportions and orientation of the gold mineralization. Once a resource estimate has been filed, investors tend to correlate the value of the company’s shares by the project’s determined ounces in the ground, its jurisdiction and access to infrastructure and skilled labour. For example, investors may value a company with a 1-million-ounce NI 43-101 compliant gold resource in Quebec, Canada at a higher premium than a 1-million-ounce gold project in a politically unstable country or a project located in a very remote area simply because the risk factor is higher.

Gold exploration companies are also keen to demonstrate that their deposits may have sizeable amounts of mineralization that has yet to be discovered. Implying that the mineralized zone is still open to be further discovered at depth or along strike. This concept means there is a prospective opportunity that the resource estimate may grow as drilling continues, therefore providing immense potential for the value of the asset to steadily increase or a ‘blue sky’ opportunity for the gold investor.

For example, Amex Exploration is completing 300,000m of drilling prior to filing their first NI 43-101. Once this initial report is filed, they may opt to start economic studies and/or continue with additional drilling, increasing the size of the resource estimate as well as the level of confidence. Once more advanced economic studies commence, the categorization of the deposit moves from ‘resources’ into the ‘reserves’ categories. Meaning there has been sufficient research and modelling given towards the mine-ability of the ore body from a both a technical and economic perspective.

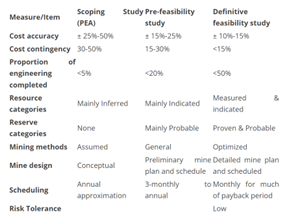

The table below gives a general overview of what to expect from mining studies. The cost percentages are given as an approximate guideline.

It is often seen that companies will exceed their capex (capital expenditure) even after the definitive feasibility study. Therefore, a monetary contingency is required in the event of budget overruns, although, even despite proper planning, certain factors may arise that were not considered. An example of this may include projects located in extremely remote areas, which may lack water, power, and road access to the mine. This lack of infrastructure may have a compounding effect, plaguing the project with extensive complications and increased capital costs. Additionally, there may be unpredictable risks with politically unstable countries as governmental regulation may slow or halt a project entirely.

Rule of thumb confidence intervals for technical studies (at assumed 90% confidence)

A preliminary report determines key project risks, further pre-development efforts required and whether to proceed forward with the project depending on the initial analysis of factors. This report is a preliminary assessment and does not provide an accurate/in-depth assessment of the economic viability of a project.

This study determines whether the identified resources can support a viable mining project. The report is accurate by approximately 15-30%. This report begins to give initial measure of the economic viability of a project which will justify proceeding towards the creation of a definitive feasibility study (DFS). If the resulting report is positive, the project would require additional funding with the eventual expansion of the drilling program. The closer a project trends towards the completion of a definitive feasibility study (DFS) there is a higher potential to attract strategic partners or a buyer of the company/asset. As a project begins to gather more attention from the public and large-scale mining companies, the gold company will begin to have less difficulties securing project funding from investors and lenders.

After-tax internal rate of return (IRR) %, and net present value (NPV) based on the current price of gold, additional calculations may be included made using a lower/higher price of gold dependent sensitivity rates.

This is an in-depth, comprehensive report that considers many elements, including but not limited to: detailed engineering work, infrastructure requirements, mining methods, recovery methods, market studies, environmental studies, permitting, social and community impact, as well as reclamation costs.

From this report, a risk profile is established and mitigation strategies are developed to further reduce uncertainty.

Demonstrate with reasonable confidence that the project can be constructed and operated in a technically sound and economically viable manner.

Provide a basis for detailed design and construction.

Enable the raising of finance for the project from banks or other sources.

This report is produced in the hope of securing project financing from banks, debt providers, strategic investors, etc. With these capital investments being used to construct the gold mine’s infrastructure and start production. The project financiers will also conduct their own due diligence with their experts before providing any capital and this can take several months.

In the past few years, major producers have not been spending capital to replace their declining reserves due to a downturn in the commodity markets. Therefore, they must look elsewhere for ore to feed their depleting mills, often turning their attention to exploration companies that have already completed the work necessary to prove the economic viability of a project. This means the potential for mergers and acquisitions may be high in the current commodity cycle. A recent example is QMX Gold which was acquired on January 21, 2021 by Eldorado Gold for approximately C$132 million, the consideration represented a 39.5% premium to the previous day’s share price.

Through these studies, the exploration companies define the ore body and demonstrate the viability. As the risk factors lower, investors with different risk profiles enter at the different stages of the resource definition. It is up to the individual to decide their risk/return tolerance and at what point they want to invest in gold exploration companies.